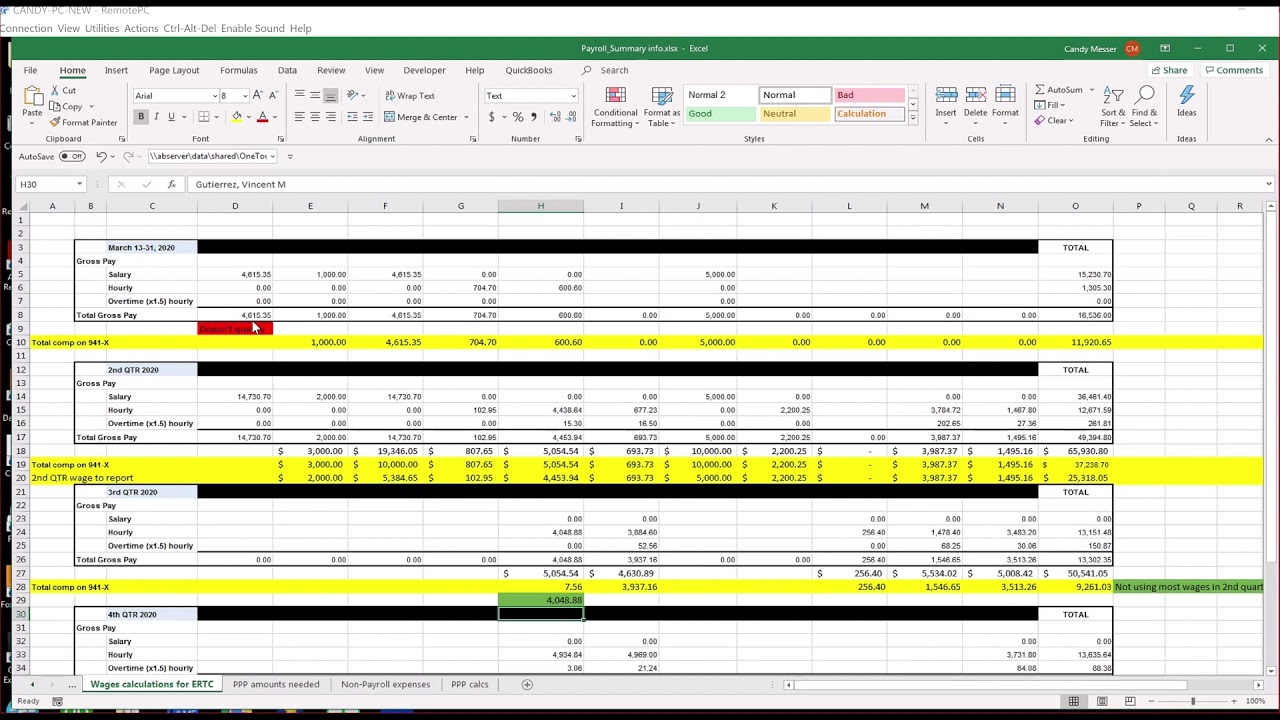

Employee retention tax credit calculator

The CARES Act Approved Special Tax Credits For Businesses Open During 2020-21. EY Employee Retention Credit Calculator.

Employee Retention Credit Erc Calculator Gusto

That is a potential of up to 5000 per.

. In 2021 your revenue mustve decreased by 20 or more. Keep your business running with the ERC Tax Credit up to 26000 Per Employee. Maintained quarterly maximum defined.

Calculator elegentcoders 2022-06-28T2046130000. Further details on how to calculate and claim the employee retention credit for the first two calendar quarters of 2021 can be found in Notice 2021-23. No limit on funding.

In 2020 your revenue must be less than 500000 in order for you to be eligible. The Employee Retention Tax Credit ERTC or ERC was created as part of the CARES Act to encourage businesses to continue paying employees by. The Employee Retention Tax Credit can be applied to 10000 in wages per employee.

Ad Find out if you qualify for the ERTC Tax Credit. Up to 26000 per employee. Increased the maximum per employee to 7000 per employee per quarter in 2021.

Take our short quiz to get an idea of how the ERC can benefit your business. Our Specialists Can Help. Ad Talk To Our Employee Retention Credit Experts To Determine If You Are Eligible For Credit.

Calculate your Tax Credit Amount. The Employee Retention Credit ERC was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES Act. Your business needs at least 10000 in.

100 Money Back Guarantee. Similarly for 2021 the retention credit is capped at 70 of qualified employers from January 1 2021 to. Any employers with a maximum of 10000 wages were eligible.

For 2020 there is a maximum credit of 5000 per eligible employee. Maximum credit of 5000 per employee in 2020. Qualified employers can claim up to 50 of their employees.

Check to see if you qualify. The Infrastructure Act terminated the employee retention credit for wages paid in the fourth quarter of 2021 for employers that are not recovery startup businesses. Ad Talk To Our Employee Retention Credit Experts To Determine If You Are Eligible For Credit.

100 Money Back Guarantee. Calculate Your ERC Refund. For 2020 the Employee Retention Credit is equal to 50 of qualified employee wages paid in a calendar quarter.

Find out if you qualify for the ERTC Program. In 2021 the ERC increased to. Ad Aprios ERC advisors are nationally recognized relief experts.

R. If youre going off of 2020 wages your ERC is 50 of the qualified wages discussed aboveyou can get a maximum ERC of 5000 per employee per. The 2020 credit is computed at a rate of 50 of qualified wages paid up to 10000 per eligible employee for the.

Maximize your cash flow with Aprios Employee Retention Credit Services. Our Tax Experts Can Help. This means that if your business had.

The 2020 ERC Program is a refundable tax credit of 50 of up to 10000 in wages paid per employee from 31220-123120 by an eligible employer. Ad We take the confusion out of ERC funding and specialize in working with small businesses. The time frame for the credit is any wages earned between March 12 2020 and Jan.

Ad Maximize Your Full Tax Credit Potential By Claiming The Employee Retention Credit. Get Up To 26k Per Employee Even If You Received PPP Money. Our Tax Professionals Can Help Determine If You Qualify for the ERTC from the IRS.

The maximum tax credit you can receive with Employee Retention Credit is 7000 per employee per quarter which adds up to 28000 per year. In 2020 a credit is available for up to 5000 per employee from 31220-123120 by an eligible employer. That is a potential of up to 5000 per employee.

The credit applies to wages paid after March 12 2020 and. Make Sure Youre Doing Things Right And Maximizing Your Claim. Get Up To 26k Per Employee Even If You Received PPP Money.

Ad The Employee Retention Credit Allows You To Get Cash Back On Qualified Employee Payroll. The employee retention credit is a credit created to encourage employers to keep their employees on the payroll. Ad Get up to 26K per employee from the IRS With the ERC Tax Credit.

Ertc Calculator From Jamie Trull Powered By Thrivecart

Determining What Wages To Use For The Ertc And Ppp Youtube

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Employee Retention Credit Owner Wages

There S A Lot Of Unclaimed Money Because You Just Didn T Know Now You Do Call Us Today Or Click Below In 2022 Unclaimed Money How To Find Out Payroll Taxes

Calculating Your Employee Retention Credit In 2022

Employee Retention Credit Erc Calculator Gusto

Calculating Your Employee Retention Credit In 2022

Avoiding Prohibited Transactions In Your Ira In 2022 Pensions Individual Retirement Account Retirement

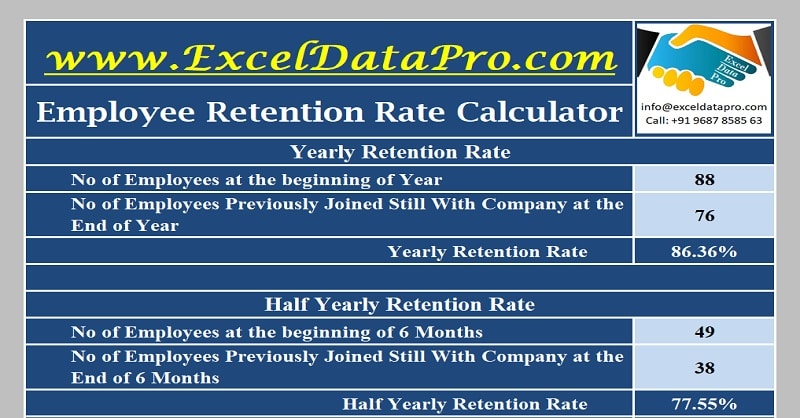

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Qualifying For Employee Retention Credit Erc Gusto

Employee Retention Credit Calculation How To Calculate Recognize

Pin On Things I Like

Irs Audits Of Erc Tax Credits Accupay Payroll

Employee Retention Credit Erc Calculator Gusto

Employee Retention Tax Credits Could Create Significant Cash Flow For Businesses Boyer Ritter Llc

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek