40+ brian is calculating his tax deductions

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Tempus Corinthiam

Use this calculator to help you determine the impact of changing your payroll deductions.

. 6 Often Overlooked Tax Breaks You Dont Want to Miss. He finds that he can deduct 1225 as a result of money given to charity 4391 from interest paid on his mortgage and 2821 from. Menu burger Close thin.

Make sure you have the table for the correct year. Learn More at AARP. Web Brian is calculating his tax deductions.

Web Brian is calculating his tax deductions. He finds that he can deduct 1225 as a result of money given to charity 4391 from interest paid on his mortgage and 2821 from what. Enter your info to see your take home pay.

Web During the 2021 tax year Brian a single taxpayer received 7600 in Social Security benefits. Web Payroll Deductions Calculator. His adjusted gross income for the year was 14500 not including the Social.

Web A tax deduction lets you subtract certain expenses from your income before you file taxes. Web Brian is calculating his tax deductions. He finds that he can deduct 1225 as a result of money given to charity 4391 from interest paid on his mortgage and 2821 from what.

Taxes Can Be Complex. His adjusted gross income for the year was 14700 not including the Social. You are then taxed on this lower amount of income instead of the amount you actually.

Web Brian is calculating his tax deductions. He finds that he can deduct 1225 as a result of money given to charity 4391 from interest paid on his mortgage and. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Web Brians Total Deduction 8437. You can enter your current payroll information and. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web Brians total deduction annual income is 8437. He finds that he can deduct 1225 as a result of money given to charity. To find your annual income first multiply your hourly rate by the number of hours worked per week then.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Web During the 2019 tax year Brian a single taxpayer received 7400 in Social Security benefits.

Academic Preparation Kit Leipzig 80th International Session Of The Eyp By International Office Of The European Youth Parliament Issuu

Australian Franchise Directory 2023 By Cgb Publishing Issuu

Buy Classmonitor Brain Development With Free App With 25 Riddles 9 Decoding Activities Crossword Puzzles 100 Letter Tiles Home Learning Kit For Kids Age Group 6 8 Years 103 Pieces Online At Low Prices

Dtt Multiplex Contract 1 Bci

Xu Magazine Issue 28 By Xu Magazine Issuu

A Reduced Generalized Force Field For Biological Halogen Bonds Journal Of Chemical Theory And Computation

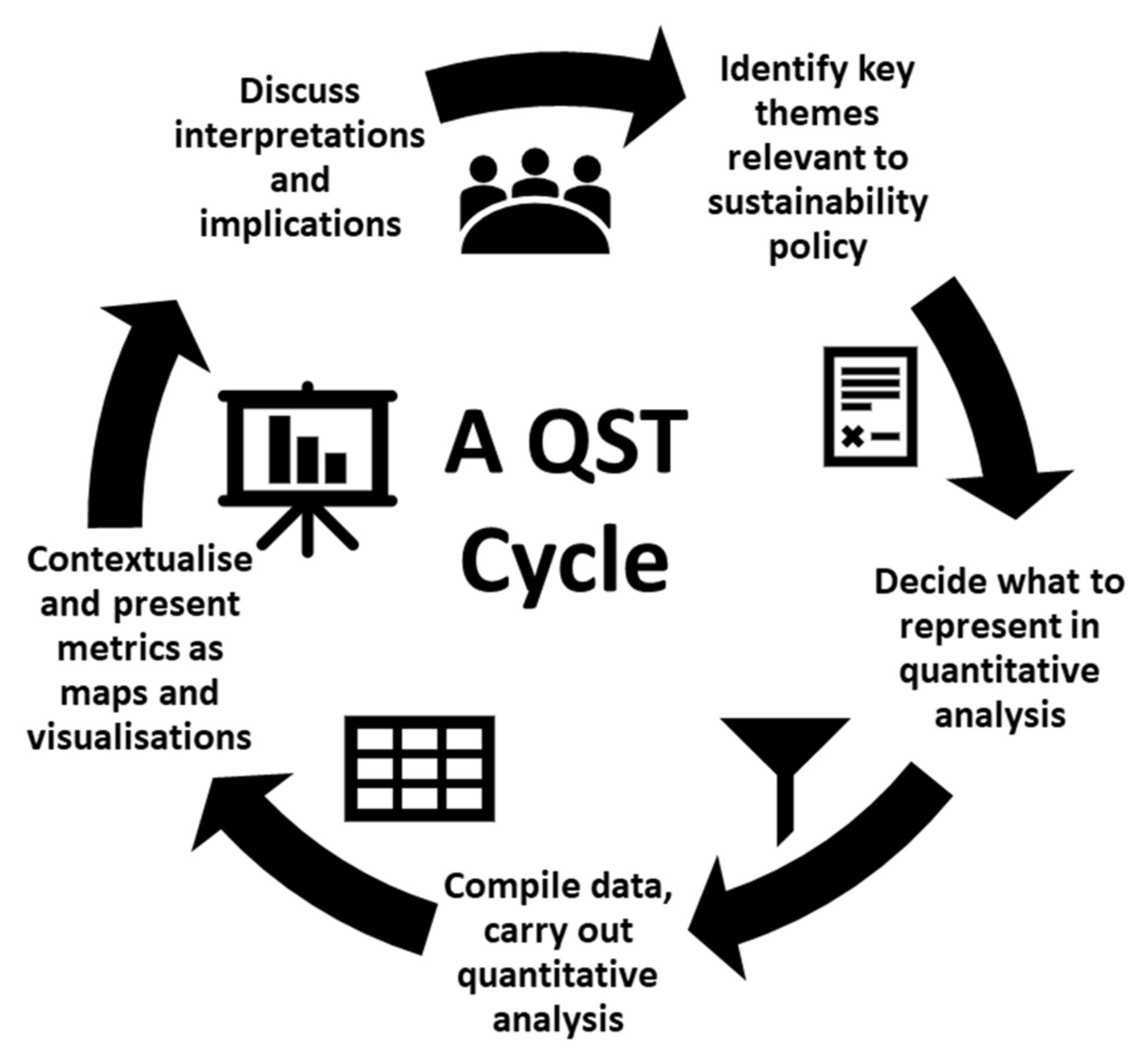

Sustainability Free Full Text Old Wine In New Bottles Exploiting Data From The Eu S Farm Accountancy Data Network For Pan Eu Sustainability Assessments Of Agricultural Production Systems

Qic Compatible With Tracknp 5 6dof Head Tracking Gaming Professional Optical Infrared Tracking System For Head Posture Game Controller As Vr For Arma Dcs Dirt F1 Euro Truck Flight Simulator Amazon De Computer

Resurety Author At Resurety

Wwl Construction 2022 By Lbresearch Issuu

Brian Espinoza Academic Help Seeking Behavior And The Effects Of So

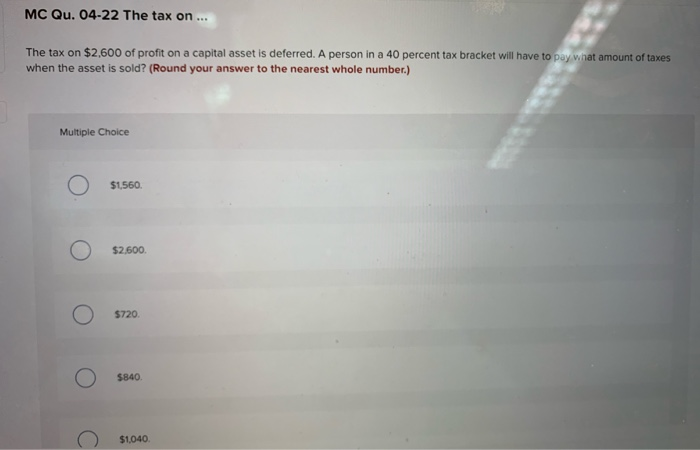

Solved Ches Problem 4 3 Calculating Tax Deductions L04 2 Chegg Com

Victorian Era Wikipedia

143 Pdf 3 27 2021 Review Test Submission Hw Income Tax Quantitative Question 1 6 Out Of 6 Points Match The Type Of Income With Its Course Hero

Brian Rohrenbach Director Pricing And Data Analytics Wencor Group Linkedin

Advanced Discounted Cash Flow Dcf Valuation Using R By Brian Lee Hardcover Barnes Noble

Breaking Va Plans Expansion Of Benefits For Disability Claims For Conditions Related To Certain Toxic Exposures Va News