Fha manufactured home loan calculator

An FHA loan is a mortgage insured by the Federal Housing Administration. FHA loans are designed for low-to.

Manufactured Housing Co Branded Manufactured Home Accomplishment Manufacturing

Like the Fannie Mae HomeStyle Renovation loan the FHA 203k loan is a government loan that can simultaneously fund the purchase of a home and renovations under one mortgage loan.

. Maximum loan for home plus land. That term can be extended up to 25 years for a loan for a multi-section mobile home and lot. You are eligible for the HomeReady or Home Possible loan programs.

FHA LOAN MAXIMUMS FOR MOBILE HOMES MOBILE HOME LOTS AND HOME-AND-LOT COMBINATIONS There are FHA loan maximums for mobile home loans up to just under 93 thousand for a manufactured home. You want to buy a two- to four-unit home with a 35 down payment. These loan officers can help you find out more about CalHFAs programs and guide you through the home buying process.

The maximum term is 15 years for a lot-only purchase. A quick look at the features of an FHA Manufactured Home Loan. If you have a home equity loan or variable-rate mortgage pay attention to the Fed.

You have at least a 35 down payment and a 580 credit score. Yes FHA has financing for mobile homes and factory-built housing. To get an FHA loan find a bank credit union or mortgage lender who works with FHA-loans.

15 years for a manufactured home lot loan. In this case you would have to use your park model RV as collateral. An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA.

The Consumer Financial Protection Bureau reports that chattel loans account for over 40 percent of all manufactured home purchase loans. We have two loan products - one for those who own the land that the home is on and another for mobile homes that are - or will be - located in mobile home parks. Park model RVs are considered movable property so.

The SF Handbook has the rules for FHA loans such as forward mortgages for borrowers who wish to buy a house condo townhome manufactured home etc. The banking institutions which will mortgage a manufactured home-with land attachment are likely to consider the exercise a high risk and will therefore reflect that risk with an inflated. Minimum down payment is 35.

Since CalHFA is not a direct lender our mortgage products are offered through private loan officers who have been approved trained by our Agency. The FHA program requires a credit score of 580 or higher and allows loan terms of up to 20-25 years for mobilemanufactured homes. Visit the Find a Loan Officer tab to contact a loan officer in your area.

Many banks simply wont mortgage or loan on a titled manufactured home and virtually none will if the manufactured home has no land attachment. You have credit scores between 500 and 619. FHA Title 1 loans for mobile homes.

The Handbook also has guidelines for other mortgage items such as FHA refinance loans and FHA reverse mortgages for qualified borrowers age 62 or older. There are two. If for some reason you fail to pay back the loan the lender can seize your property.

The bottom line is that if you want to own a home a manufactured one might be the way to go. 25 years for a loan on a multi-wide manufactured home and lot. An FHA Title I loan can be used for refinancing a manufactured home as well as purchasing one.

How about manufactured housing and mobile homes. 2 min read Sep 15 2022 Latest mortgage news. Land and Home Real Estate Loans Refinances Purchase Money Conventional FHA VAFHA 203k rehabilitationLoans for any age pre-HUD homes older than 1977Loans for manufactured home multi-family propertiesReal Estate 433A conversions programs Construction Real Estate Loans Available as FHAVA and USDAPermanent Loan is closed before construction begins.

Rates surge further past 6 a 14-year high. Ask an FHA lender to tell you more about FHA loan products. Qualifying for an FHA loan is a good choice if.

Term is typically 20 years. Allowing down payments as low as 35 with a 580 FICO FHA loans are helpful for buyers with limited savings or lower. Qualifying for a VA loan may be a good option if.

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

Foundation Inspection Requirements Cost For Manufactured Homes

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Manufactured Home Loans Arkansas Federal Credit Union

Manufactured Homes Offer Relief As Affordability Squeeze Tightens Bankrate

Facts About Fha Manufactured Homes Loans

Can I Get An Fha Loan For A Mobile Home

How To Finance A Mobile Home Nextadvisor With Time

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

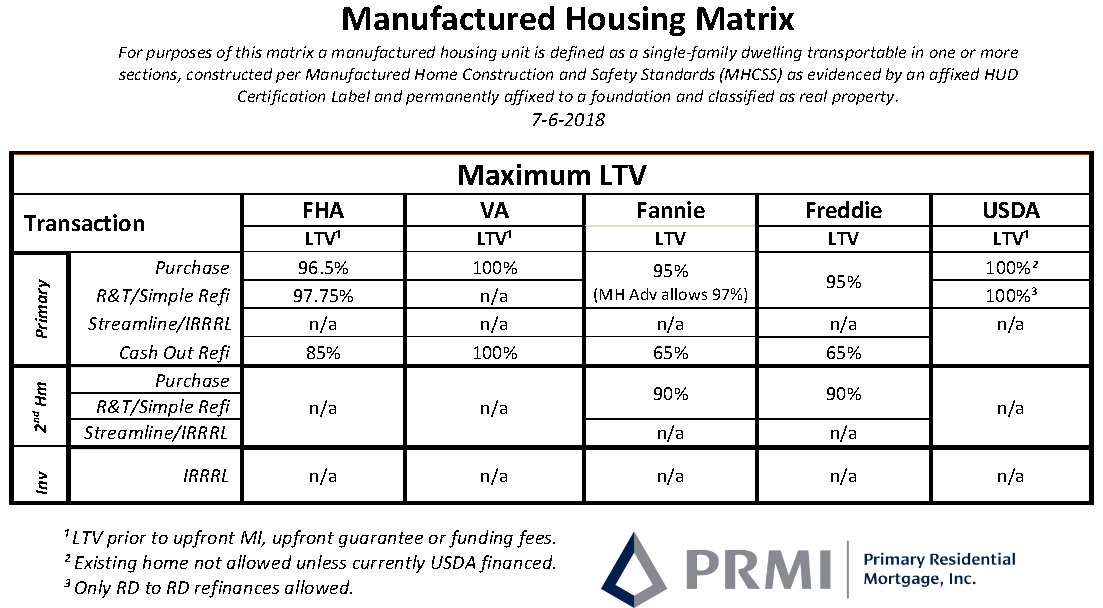

Delaware Manufactured Home Loans Prmi Delaware

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Nerdwallet

Fha Rules For Manufactured Modular Homes

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Can I Get Approved For Cash Out On My Manufactured Home 1 Manufactured Home Loan Lender In All 50 States

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Ultimate Guide To Manufactured Homes Forbes Advisor